Investments

Investments

Investments

Investments

Expand Financial (Expand) serves as a 3(38) investment fiduciary to oversee the plan’s investment menu giving you the expertise to maintain quality investments and meet ERISA standards. 3(38) Services Fact Sheet

Investment Policy

Expand provides a written Investment Policy Statement (IPS) to guide investment decisions.Quarterly Monitoring

Expand monitors the investment lineup each quarter to ensure investments are meeting standards defined in the IPS.Quarterly Reports

Expand provides you with quarterly plan investment reports that you and your advisor can review together.Fund Replacements

If an investment fails to meet the IPS standards, Expand replaces investments as needed.Core Investment Lineup

Participants can choose their own investment options and asset allocation from the following investments.

See important investment disclosures at the bottom of this page.

Managed Account Options

Passport401k offers five different managed account options to simplify and streamline participant investing. Employers and their Investment Advisors choose one of the following options.

PIMCO RealPath Blend®

RealPath Blend target date funds deliver a simple, all-in-one investment strategy for retirement savers, helping you invest appropriately for where you are on the path to retirement and improve your future financial security.American Funds Target Date

American Funds target date funds are designed to invest in a diversified portfolio of stocks and bonds that automatically adjusts over time as you approach and enter retirement.Vanguard® Target Retirement Funds

Vanguard target date funds provide broad diversification while incrementally decreasing exposure to stocks and increasing exposure to bonds as each fund’s target retirement date approaches.Janus Henderson Global Allocation Funds

Janus Henderson Global Allocation Funds offer broad global diversification for investors through a strategic allocation across equities, fixed income and alternatives. Choose the option best suited to your risk tolerance.StoryLine® by Stadion

StoryLine provides participants with a personalized investment experience considering variables unique to each participant. Stadion serves as a participant fiduciary and is required to act in the best interest of participants.Click one of the options below to see more details.

PIMCO RealPath Blend® Target Date Funds

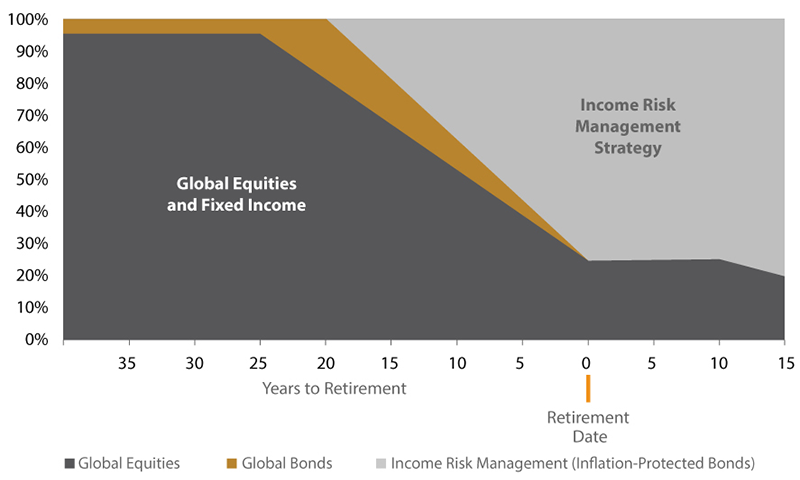

Combining the power of PIMCO’s world-class active fixed income capabilities with the efficiency of Vanguard’s passive equity, PIMCO RealPath Blend seeks an optimal balance of achieving long term objectives with below-average expense ratios.

RealPath Blend target date funds deliver a simple, all-in-one investment strategy for retirement savers, helping you invest appropriately for where you are on the path to retirement and improve your future financial security.

Retirement planning is about more than saving and investing. We designed RealPath Blend to help make your path to a successful retirement a smoother one. Here’s how we do it.

Simple

No matter where you are in your retirement journey, there’s a RealPath Blend target date fund for you. Each fund is associated with a year, (e.g. 2030, 2035, 2040, etc.) which is the fund’s ‘target date’ – or the year closest to when you think you’ll retire.Automatic

RealPath Blend’s investment professionals adjust your fund’s mix while you’re on your retirement journey — more in stocks when retirement is far off to help you grow your savings, shifting more to bonds as retirement gets closer to help protect what you’ve saved.Diversified

Each fund is made up of 13 different types of investments, including stocks from a wide range or U.S. companies and bonds sources from around the world, to help ensure your retirement savings are well diversified at any given point in time.Balanced

Target-date funds are designed to help cushion your investment from the ups and downs of the market, helping you feel confident in your retirement plan at all times.Target Date Fund Disclosures

Target Date Funds are designed to provide investors with a retirement solution tailored to the time when they expect to retire or plan to start withdrawing money (the “target date”). Target Date Funds will gradually shift their emphasis from more aggressive investments to more conservative ones based on their target dates. Target Date Funds invest in other funds and instruments based on a long-term asset allocation glide path developed by PIMCO, and performance is subject to underlying investment weightings, which will change over time. An investment in a Target Date Fund does not eliminate the need for an investor to determine whether a Fund is appropriate for his or her financial situation. An investment in a Fund is not guaranteed. Investors may experience losses, including losses near, at, or after the target date, and there is no guarantee that a Fund will provide adequate income at and through retirement.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2024, PIMCO

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

The funds are offered in five-year increments, with the target date indicating when an investor may expect to retire and stop making contributions to the fund.

Available Investments and Performance History

American Funds Target Date Retirement Series

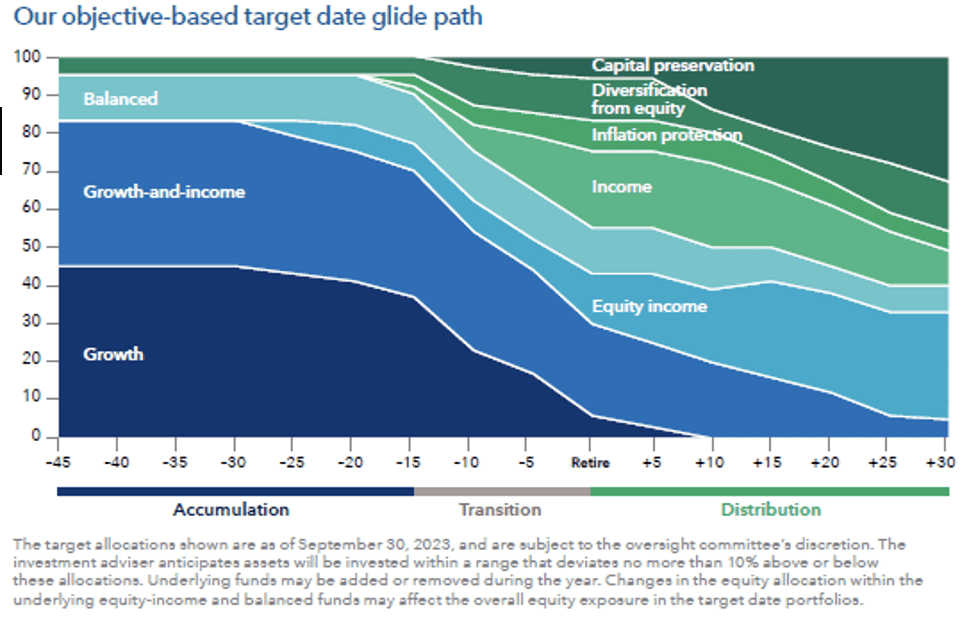

Target date funds have a lot in common. But the American Funds Target Date Series takes a distinctive approach that has delivered uncommon investment outcomes and helped thousands of participants come closer to achieving their financial dreams.

Each American Funds target date fund is designed to invest in a diversified portfolio of stocks and bonds that automatically adjusts over time as you approach and enter retirement. As a participant nears retirement, that mix of investments will gradually shift toward more conservative stocks and bonds. This gradual shift over time is called a “glide path.”

The American Funds Target Date Series approach to allocating between stocks and bonds differs from some other target date managers. As a participant’s retirement date approaches, a greater emphasis is placed on dividend-paying stocks in an effort to provide more equity exposure while managing volatility. This approach can also help manage the risk of outliving retirement savings.

Target Date Disclosures

Although the target date portfolios are managed for investors on a projected retirement date time frame, the allocation strategy does not guarantee that investors’ retirement goals will be met. Investment professionals manage the portfolio, moving it from a more growth-oriented strategy to a more income-oriented focus as the target date gets closer. The target date is the year that corresponds roughly to the year in which an investor is assumed to retire and begin taking withdrawals. Investment professionals continue to manage each portfolio for approximately 30 years after it reaches its target date.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

For more information, visit us at targetdatesimplified.com.

American Funds Distributors, Inc.

Vanguard® Target Retirement Funds

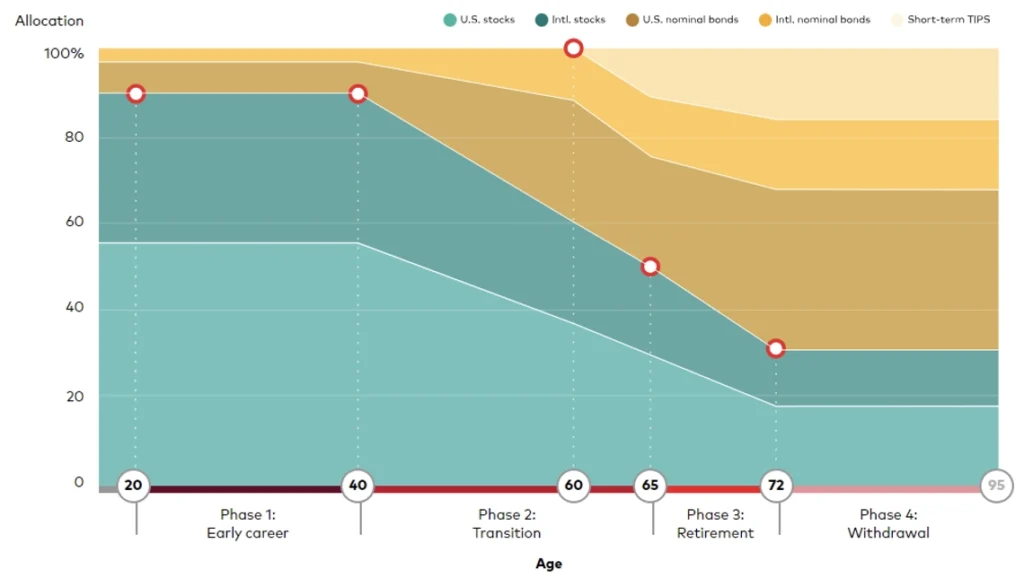

Vanguard Target Retirement Funds are target date funds designed for retirement. They offer a diversified portfolio within a single fund that adjusts its underlying asset mix over time. These funds provide broad diversification while incrementally decreasing exposure to stocks and increasing exposure to bonds as each fund’s target retirement date approaches.

Vanguard Target Retirement Funds blend investment theory with four decades of behavioral insights to design a TDF glide path that helps participants retire when they want, with enough money to live comfortably. It presents your participants with a carefully calibrated balance between risk and reward that may look simple on the surface but is backed by decades of research. This thoughtful approach allows our TDFs to more fully support income throughout a participant’s retirement.

More information on Vanguard Target Retirement Funds can be found at https://institutional.vanguard.com/investment/strategies/target-date-funds-approach.html.

Target Date Disclosures

Investments in Target Retirement Funds are subject to the risks of their underlying funds. The year in the Fund name refers to the approximate year (the target date) when an investor in the Fund would retire and leave the work force. The Fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. The Income Fund has a fixed investment allocation and is designed for investors who are already retired. An investment in the Target Retirement Fund is not guaranteed at any time, including on or after the target date.

Center for Research in Security Prices, LLC (CRSP®) and its third-party suppliers have exclusive proprietary rights in the CRSP® Index Data, which has been licensed for use by Vanguard but is and shall remain valuable intellectual property owned by, and/or licensed to, CRSP®. The Vanguard Funds are not sponsored, endorsed, sold or promoted by CRSP®, The University of Chicago, or The University of Chicago Booth School of Business and neither CRSP®, The University of Chicago, or The University of Chicago Booth School of Business, make any representation regarding the advisability of investing in the Vanguard Funds.

Vanguard is responsible only for selecting the underlying funds and periodically rebalancing the holdings of target-date investments. The asset allocations Vanguard has selected for the Target Retirement Funds are based on our investment experience and are geared to the average investor. Regularly check the asset mix of the option you choose to ensure it is appropriate for your current situation.

Janus Henderson Global Allocation Funds

Janus Henderson Global Allocation Funds

As a leading global asset manager, Janus Henderson offers numerous investment options designed to help you reach your investment goals. After looking at our investment line-up, you may be feeling overwhelmed and not sure where to start. We aim to make investing with us an easy process for our clients. Janus Henderson Global Allocation Funds offer broad global diversification for investors through a strategic allocation across equities, fixed income and alternatives, with the goal of providing the opportunity for higher returns and lower volatility.

These funds of funds offer broad global diversification in a single investment by utilizing the full spectrum of Janus Henderson Investment expertise and solutions. The Funds are built to match your risk tolerance.

GLOBAL ALLOCATION FUND – CONSERVATIVE (JCAIX)

GLOBAL ALLOCATION FUND – MODERATE (JMOIX)

GLOBAL ALLOCATION FUND – GROWTH (JGCIX)

The following chart shows performance history of the Janus Henderson Global Allocation Funds.

StoryLine by Stadion

Stadion StoryLine is a professionally professionally managed account solution. It starts with an important premise: Every company – and every employee in that company – has a unique story. And those stories should inform their retirement plan. StoryLine is built with the funds from the underlying investments within the plan’s core lineup and portfolio allocations and glide paths are tailored at the company level and further refined at the participant level based on their age and risk tolerance questionnaire. View StoryLine Website

Professional Money Management

StoryLine provides a personalized investment experience considering variables unique to each participant, at no cost to the employer.Customized Risk Management

StoryLine attempts to make retirement investing easy – no need for participants to research investments, select funds, or make decisions. StoryLine seeks to manage participant emotions and improve outcomes.Hands-On Support

A Consultant from Stadion can provide on-site enrollment support, if requested. In addition, Stadion provides participants with live phone support to discuss investments.Plan-Level Customization

StoryLine goes beyond simple risk and age-based assessments. Plan-level customization takes into account a company’s unique workforce, and participants further tailor their account with Stadion’s proprietary risk tolerance questionnaire.The S&P 500 Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. It is not possible to invest directly in indexes (like the S&P 500) which are unmanaged and do not incur fees and charges. Investments are subject to risk and any of Stadion’s investment strategies may lose money. Past performance is no guarantee of future results.

StoryLine is a marketing term associated with investment advisory services and products provided by Stadion Money Management, LLC. Certain of the StoryLine accounts and funds utilize exchange-traded funds that bear the SPDR® trademark to implement Stadion’s investment strategy. Stadion receives both an annual payment and reimbursement for certain marketing and other assistance in connection with the StoryLine Accounts from State Street Global Advisors or its affiliates in connection with Stadion’s use of SPDR® ETFs in the StoryLine Accounts.

StoryLine is not managed, sponsored or endorsed by State Street Global Advisors or its affiliates and is not guaranteed by Stadion or its affiliates or by State Street Global Advisors or its affiliates. No party makes any representation or warranty, express or implied, regarding the advisability of investing in the StoryLine Accounts, including “StoryLine. Built with SPDR® ETFs.” State Street Global Advisors has no obligations to take into consideration the StoryLine Accounts or investors in the StoryLine Account when managing or creating SPDR® ETFs. Standard & Poor’s®, S&P®, S&P 500®, Standard & Poor’s 500, 500, Standard & Poor’s Depositary Receipts, and SPDRs® are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by State Street Global Markets, LLC.

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC(S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third-party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

Custom Plan Level Qualified Default Investment Alternative (QDIA)

Determining a plan QDIA is an important fiduciary step. Stadion’s StoryLine offers customized plan level default glide paths designed to align with the participant population. Each plan sponsor has access to a document explaining how certain inputs may affect a plan default selection.

Plan Level QDIA Example

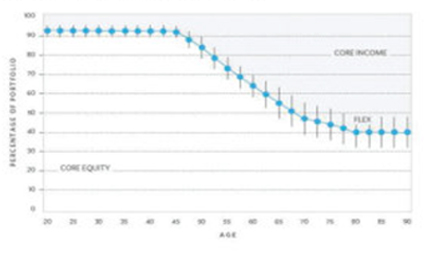

This chart shows how the mix of investments will be adjusted gradually over time to seek to reduce risk to help plan participants preserve what they’ve saved as they near retirement.

Founded in 1993, Stadion is an investment management firm that provides custom solutions to retirement plan advisors, plan sponsors and participants. We are proud of our ability to work with advisors by providing advisors with turnkey managed account services, target date fund solutions, and the opportunity to build custom managed accounts. Stadion believes that one-size-fits-all investment approach offered to most retirement plan participants does not account for the differences of each individual, which is why we work closely with advisors and recordkeepers to build custom retirement plan and participant level investment solutions.

Below are important disclosures about the investment information presented on this page.

Investment Chart Data Sources.

On the above chart, the columns for Investment Name, Morningstar Category, Inception Date, Expense Ratio and return information is provided by Morningstar, Inc. The columns specifying QDIA as well as the list of funds is provided by eFiduciary Advisor. ‘Principal Focused – Extended Duration’ investment option will have underlying fixed income investments with a longer average duration than a Cash Equivalent.

Stable Value and Fixed Income Disclosures.

Some Stable Value and Fixed Income Investment Options include restrictions at contract termination. Plan Sponsors should carefully review product contracts for applicable limits, rules and payout options.

© 2025 Morningstar, Inc. All Rights Reserved.

The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.